The telecommunications industry is experiencing a significant upheaval, particularly within the optical module sector, with recent developments highlighting the rapid growth and competitive landscape of this market. On December 19, major players in the CPO (Co-packaged Optics) segment witnessed a surge in their market performance, with several companies, including Ruijie Networks, reaching their daily trading limits. Other companies, such as Guangxun Technology and Boke Technology, also reported impressive stock performance, indicating a broader trend of growth within the sector.

Since the end of September, the optical module index has seen a consistent upward trajectory, indicating a robust recovery in demand after a challenging period. The exports of optical modules from China have been on a steady rise, as evidenced by the compound annual growth rate of 12.26% from 2015 to 2023. Particularly notable is the record-setting export volume seen in November and December of 2023, showcasing the global demand for these critical components.

Despite being an essential component in the optical communications industry due to their ability to convert light into electrical signals and vice versa, optical modules face a unique set of challenges. While they occupy a crucial position in the supply chain, the low barriers to entry have resulted in intense competition among manufacturers, leading to a situation where many companies struggle to differentiate themselves and maintain profitability.

The dynamics of the optical module market are starkly reminiscent of assembly operations, with significant competition resembling a red ocean where many players vie for attention. According to a study by the leading research firm Yole, the market is remarkably fragmented; for instance, in 2020, Finisar, the market leader, held only a 16% share, while its closest competitor, Lumentum, had about 11%. The low concentration rate reflects the ongoing struggle for market share among numerous competitors.

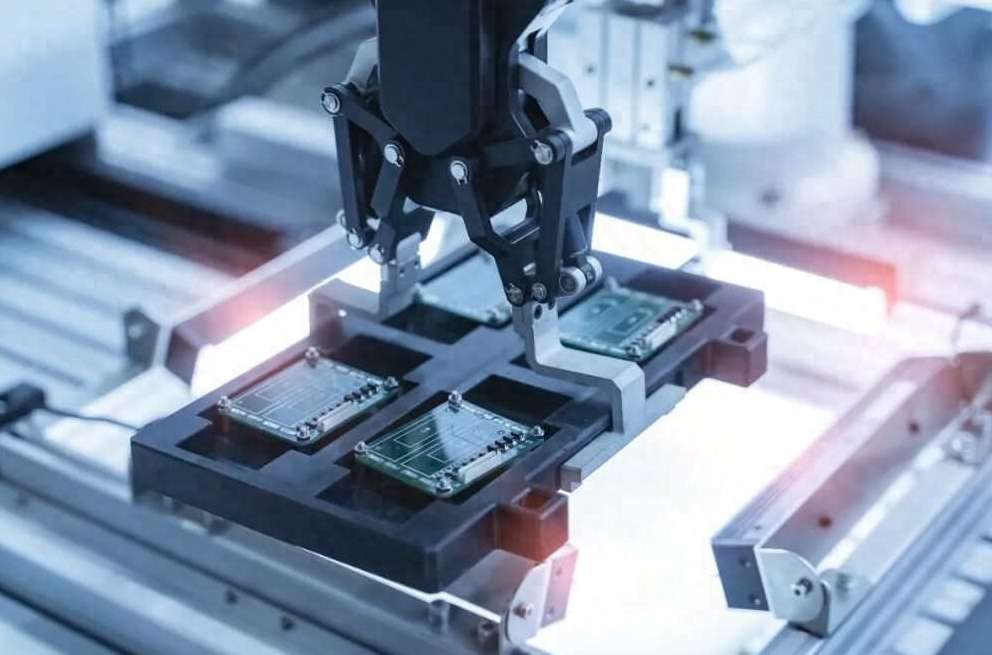

To survive amid fierce competition, optical module manufacturers are compelled to innovate continuously. Products have evolved significantly over the years. For example, 10G optical modules were leading in 2000. However, with the exponential growth of internet traffic in the subsequent years, the 10G Ethernet speed became inadequate. This prompted manufacturers to develop higher-speed options such as 25G and 40G modules, leading to a decline in demand for 10G products.

Historically, when new products are launched, initial prices tend to be higher due to limited competition. However, as rival firms begin to catch up technologically, prices typically decline by 10% to 20% annually, diminishing profitability margins until newer, faster optical module technologies emerge to rejuvenate the market cycle.

In recent years, however, a paradigm shift has occurred as more manufacturers recognize the critical importance of developing proprietary technologies. This involves venturing upstream into chip production, a crucial aspect of optical modules, as companies strive to compete more effectively against established international players. The stakes have never been higher as firms seek to gain a foothold in the premium optical module market where significant profit margins are attainable.

Currently, Chinese firms have established a comprehensive presence across various transmission rate categories, including 10G, 25G, 40G, 100G, and even 400G. New entrants are also emerging in the 800G space, where several local companies have launched their products faster than foreign competitors, thereby building early market advantages. In the chip domain, advancements in 10G DFB and EML technology are being made, with some manufacturers even capable of mass production in 25G devices, marking a crucial step toward overcoming the technology barriers historically slowing growth.

Back in 2015, a mere single Chinese firm was among the top ten global optical module manufacturers. Fast forward to 2020, and the landscape has changed dramatically, with several names, including Zhongji Xuchuang, Hisense Broadband, and Huagong Technologies joining the ranks. This remarkable progress has seen Chinese firms capture over 30% of the global market share in optical modules.

The demand trajectory in the optical module industry appears closely linked to downstream demand trends, akin to investment logic in the semiconductor sector. Significant capital expenditures from key players, like TSMC and Samsung, often signal the beginning of a new semiconductor cycle. A similar correlation is emerging in the optical module space.

The burgeoning requirements for data transmission driven by emerging technologies such as the metaverse, cloud computing, AI, and 5G are creating an enormous surge in demand for optical modules. This has prompted not only telecommunications operators but also cloud service companies to ramp up their capital expenditures.

With increased capital expenditures in the downstream sector, rapid expansion in base stations and data centers is poised to ignite a new growth cycle for optical modules. Industry insiders have reported substantial order backlogs for publicly traded companies such as Zhongji Xuchuang and Huagong Technology, particularly in their optical module sectors. Companies that expand into upstream chip production or find ways to produce more cost-effectively are likely to excel in this explosive growth environment.

Research by Huazhang Securities indicates that as the domestic self-sufficiency in optical chips increases, profit margins in the optical module sector could significantly improve. A self-sufficient model could yield profits approaching 55%, a stark contrast to the current 20% to 30% margins many companies are grappling with.

Currently, companies listed on the A-share market, such as Guangxun Technology and Huagong Technology, are proactively extending their businesses into the upstream optical chip sector.

Notably, Guangxun Technology has made strategic acquisitions with IPX from Denmark in 2012 and Almae from France in 2016, gaining production capabilities in both passive chips and advanced active optical chips for applications above 10G. As a result, Guangxun has successfully launched its 25G optical chips into large-scale production.

Meanwhile, Huagong Technology has adopted a partnership approach to engage with the optical chip market. In January 2018, it collaborated with an international expert team to establish Wuhan Yunling Optoelectronics Co., Ltd., focusing on high-end optical communication chip products. This company boasts a production capacity exceeding 70 million chips annually, making it a frontrunner in the Chinese market.

Observing the growth trajectories of established international players like Finisar and Lumentum reveals that simultaneous engagement in upstream chip manufacturing and midstream module production enhances companies' ability to manage the supply chain effectively while ensuring product quality. This integrated approach is pivotal for scaling operations and ultimately growing into industry giants.

Looking forward, if Chinese companies can achieve further advancements in chip technology and increase production capacity, we could see Guangxun Technology and Huagong Technology capturing a substantial portion of the optical module market in the future. The competitive landscape is evolving, and these companies are poised to redefine their roles within a rapidly changing environment.

Share Your Thoughts