The April economic data released by the UK's Office for National Statistics paints a nuanced picture of the nation's financial landscape, revealing a modest yet crucial growth trajectory. Over the three months leading up to February 2024, the output of the UK’s real Gross Domestic Product (GDP) increased by 0.2%, with a similar performance observed in the service sector, which also saw a 0.2% rise. Interestingly, the production sector outperformed this modest growth with a 0.7% increase. When analyzed month-over-month, GDP experienced a 0.1% uptick in February, continuing January's trend, where it had risen by 0.3%. This indicates a steady, if not spectacular, growth pattern emerging amidst various underlying factors.

A closer inspection of the statistics highlights that within the spectrum of 14 service sectors, eight experienced positive growth during this period. Notably, professional services, including legal and accounting sectors, alongside technical services, made a significant contribution, with a reported growth of 1.1%. Transportation and warehousing services also surged, managing a 2.2% increase. However, this growth narrative isn’t without its challenges. The repercussions of ongoing conflicts in the Middle East led to intermittent disruptions in global supply chains, specifically impacting wholesale and retail trade. This sector, along with automotive repair services, experienced a slowdown in growth rates, reflecting broader economic uncertainties.

Despite these setbacks, the consumer-oriented service sector showed slight growth of 0.2%. The primary drivers for this growth were recreational and sporting activities, which saw a remarkable increase of 3.6%. Conversely, real estate-related services faced significant declines, with outputs falling by 1.1%, suggesting a cautious attitude amongst consumers regarding future income stability and investment in real estate.

Continuing this theme of growth, the British private sector recorded its sixth consecutive month of expansion in April. Though there was a notable rise in new orders, which spurred an increase in hiring, businesses remain on alert due to inflationary pressures and low levels of market confidence, which appear to be hampering a full-scale economic recovery. The latest composite Purchasing Managers' Index (PMI) published by S&P showed a rise from 52.8 in March to 54.0 in April, with the services PMI advancing from 53.1 to 54.9 – the largest jump observed in nearly a year, signaling robust business activity.

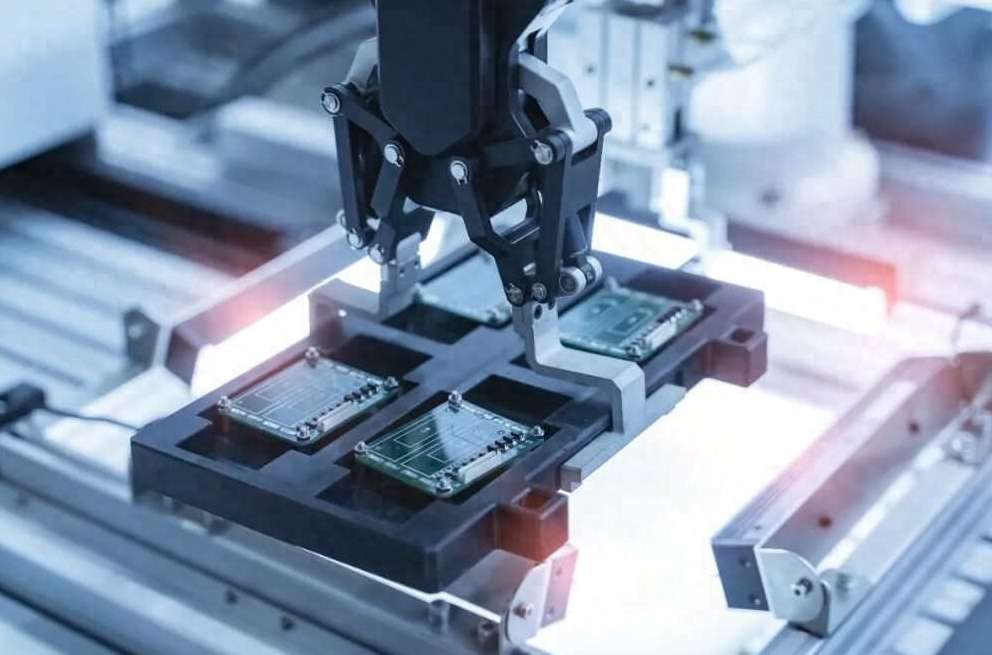

Moreover, the British manufacturing sector has also begun to show signs of rejuvenation. Data from February indicates that manufacturing output rose by 1.2%, with 11 out of 13 sub-sectors experiencing positive growth; automotive manufacturing notably led this charge with a substantial 3.7% increase. According to the Society of Motor Manufacturers and Traders (SMMT), there was a staggering 14.6% year-on-year growth in the automotive sector for that month. This surge is attributed to heightened car import demands from both Asian and American markets, as well as domestic market needs driven by vehicle upgrades and government incentives favoring electric vehicles.

On the flip side, the food, beverage, and tobacco industries also recorded impressive growth, with a 1.3% increase, indicative of rising consumer disposable incomes and increased spending in hospitality and entertainment. However, not all sectors are on an upward trajectory. The output from machinery and equipment manufacturing saw a decline of 3.3% in February, correlating with a similar downturn in construction output, which fell by 1.0%, highlighting potential vulnerabilities within these sectors.

Looking ahead, the sustainability of this manufacturing growth remains uncertain. S&P Global’s forecasts suggest a potential downturn in April, indicating that the rising trend of manufacturing orders could be at risk of reversal. Following brief rebounds in February and March, buoyed by improved domestic and international market conditions and heightened demand for electronics and machinery, prospects for continued momentum in April appear grim. Contributing factors include disruptions caused by geopolitical uncertainties, particularly the Middle Eastern conflict, which could impede production capabilities and introduce volatility to operational expenses.

Further complicating the economic landscape is the domestic inflationary pressure, which could exacerbate as average input costs across the private sector increased in April. The risk of inflation rebounding looms as the tight labor market has yet to show significant improvement, leading to a surge in production costs within the service industries, outpacing those faced by manufacturers. The transportation and raw material price increases, compared to levels a year prior, reflect a substantial challenge to manufacturers, who face growing pressures without a corresponding rise in the prices of their end products due to competitive market dynamics.

Consequently, the goal of keeping inflation below the 2% target level is fraught with uncertainty. The combined influences of labor costs, energy prices, and a robust market demand may compel businesses to adjust prices upwards, further complicating the inflationary environment. Subsequent predictions from the Bank of England suggest inflation rates could rebound toward 3% by the year's end, with expectations for the first interest rate cut possibly announced in late June or August, contingent upon developments in inflation metrics.

Nevertheless, questions remain about whether the UK economy can genuinely escape the specter of recession. The slight economic growth in February, bolstered by the promising PMI for April, hints at a potential recovery. Still, rising inflationary trends threaten to cast doubt on core inflation remaining below targets set by the Bank of England. Additionally, the significant burden of national debt, currently around £2.7 trillion—akin to one year's GDP—poses substantial constraints on fiscal policy, primarily due to the high-interest costs that limit government spending capabilities on public services and infrastructure vital for stimulating growth.

Overall, the current state of the UK's economic trajectory is a tapestry woven with both promising advancements and persistent challenges. While the sectors demonstrate resilience and adaptability in the face of adversity, the path forward remains laden with uncertainty. The interplay between inflation, market confidence, and overall productivity will ultimately determine whether the UK can not only recover from its recent past but also forge a robust foundation for future growth.

Share Your Thoughts